Insurance email marketing has become an essential tool for insurance companies looking to engage with clients, boost retention, and drive conversions. In today’s competitive market, email campaigns allow businesses to connect with customers in a personalized, cost-effective, and timely manner. This blog post will explore the key strategies, best practices, and emerging trends in insurance email marketing, offering insights on how to optimize your campaigns for maximum impact and business growth. Whether you’re just getting started or looking to refine your existing strategy, these insights will help you make the most of your email marketing efforts.

Introduction to Insurance Email Marketing

In today’s digital world, email marketing has become an essential tool for businesses across all industries. For insurance companies, email marketing presents a unique opportunity to reach clients in a personalized, timely, and cost-effective manner. Insurance email marketing is a strategic approach that focuses on using email as a direct communication channel with both potential and existing clients. By leveraging email campaigns, insurance companies can build stronger relationships, increase customer retention, and ultimately drive more conversions.

Email marketing enables insurers to deliver relevant content and personalized offers directly to their clients’ inboxes. Whether it’s sending policy updates, offering new products, or reminding clients about policy renewals, insurance email marketing ensures that businesses stay connected with their audience at every stage of their customer journey.

The power of insurance email marketing lies in its ability to target specific segments with tailored messages. By utilizing data such as customer preferences, demographics, and previous interactions, insurance companies can craft messages that resonate with each individual. This not only helps in building trust but also enhances the likelihood of conversions.

In the next sections, we will delve deeper into why email marketing is crucial for insurance companies and how it can help in maximizing client engagement and boosting conversion rates.

Why Email Marketing is Crucial for Insurance Companies

Email marketing is a powerful and cost-effective tool that plays a crucial role in the success of insurance companies. In an industry where customer retention and engagement are key, insurance email marketing allows businesses to establish a continuous connection with their clients, offering both value and personalized communication. Here’s why email marketing is crucial for insurance companies:

1. Building Stronger Customer Relationships

In the competitive world of insurance, maintaining strong relationships with customers is essential. Email marketing allows insurance companies to stay in touch with clients, ensuring they are informed about policy updates, offers, and other important information. By regularly communicating with clients through emails, insurance companies can nurture these relationships, fostering trust and loyalty over time.

2. Cost-Effectiveness

Compared to traditional advertising channels, such as print or TV, email marketing offers a far more affordable option for insurance companies. With email campaigns, businesses can reach a large audience at a fraction of the cost. Whether you’re sending out a weekly newsletter or a personalized offer, email allows for scalability without the need for significant financial investment.

3. Personalization and Targeting

One of the greatest advantages of insurance email marketing is the ability to tailor messages based on customer data. Insurance companies can segment their email lists by demographics, policy types, or customer behavior, ensuring that each recipient gets relevant and personalized content. This personalized approach makes clients feel valued, increasing the likelihood of engagement and conversions.

4. Automation and Efficiency

Email marketing allows insurance companies to automate many of their communication efforts. Automated email campaigns can be triggered based on specific actions, such as policy renewals, claims status updates, or new product offerings. This automation saves time and ensures timely communication without the need for constant manual effort. Furthermore, it allows insurance companies to scale their outreach efforts, keeping clients informed without overwhelming staff.

5. High Return on Investment (ROI)

Email marketing has one of the highest returns on investment (ROI) in digital marketing. For every dollar spent, insurance companies can see substantial returns in terms of customer engagement and conversions. With the ability to track open rates, click-through rates, and conversions, insurance businesses can continuously refine their email marketing strategies for even greater ROI.

By leveraging these benefits, insurance companies can enhance customer loyalty, increase brand visibility, and drive new business. As we move further into the digital age, insurance email marketing will continue to be an indispensable tool for industry success.

Key Benefits of Insurance Email Marketing

Insurance email marketing offers a wide array of benefits for insurance companies looking to improve customer engagement, retention, and conversions. By utilizing email as a communication channel, insurance businesses can connect with their clients in a personalized, timely, and effective way. Here are some key benefits of insurance email marketing:

1. Increased Customer Retention

One of the most significant advantages of insurance email marketing is its ability to increase customer retention. Insurance companies can use email to send regular updates, reminders, and policy renewal notices. By staying connected with clients, even after a sale, insurance companies can ensure that customers remain satisfied with their service and are less likely to switch providers. Engaging clients through email helps reinforce the relationship, increasing the likelihood that they will stay loyal.

2. Improved Lead Generation and Conversions

Email marketing is an effective way to nurture leads and drive conversions. Through targeted email campaigns, insurance companies can educate potential clients about different types of insurance products, special offers, or discounts. Well-crafted emails that address a customer’s specific needs or concerns can encourage them to take the next step—whether that’s requesting a quote, scheduling a consultation, or purchasing a policy. The ability to send personalized, relevant offers makes it easier to convert leads into paying customers.

3. Enhanced Customer Engagement

Effective insurance email marketing can significantly boost customer engagement. By sending valuable content—such as insurance tips, industry news, or FAQs—insurance companies can encourage customers to interact with their emails. Engaged customers are more likely to open future emails, click through to links, and share content with others. This increased interaction builds a stronger bond between the company and the customer, which can translate into increased trust and more business opportunities.

4. Better Segmentation and Targeting

Another benefit of insurance email marketing is the ability to segment your audience based on customer data. By segmenting email lists by factors such as policy type, age group, location, or even previous interaction history, insurance companies can send highly targeted messages to specific groups. This ensures that each email feels relevant and tailored to the recipient, leading to higher open rates, click-through rates, and ultimately, better conversion rates.

5. Cost-Effectiveness and Scalability

Email marketing is one of the most cost-effective ways to reach a large audience. Unlike traditional advertising methods, such as TV or print media, which can be expensive and limited in scope, email marketing allows insurance companies to communicate with thousands of people at a fraction of the cost. Furthermore, email marketing campaigns can easily be scaled to fit any size business, making it an ideal solution for both small agencies and large insurance providers.

6. Trackable and Measurable Results

One of the key advantages of insurance email marketing is the ability to track and measure performance. With detailed analytics on open rates, click-through rates, conversions, and more, insurance companies can assess the success of their campaigns in real-time. This allows businesses to quickly identify what is working and what needs improvement, enabling them to optimize future campaigns for even better results.

By taking full advantage of these benefits, insurance companies can not only maintain strong relationships with existing clients but also attract new customers and drive business growth.

Types of Email Campaigns for Insurance Companies

Insurance email marketing offers a variety of campaign types that can help insurance companies engage with their clients, promote services, and increase conversions. The key to a successful email marketing strategy lies in understanding which types of campaigns work best for different stages of the customer journey. Here are the most effective types of email campaigns for insurance companies:

1. Welcome Emails

A welcome email is the first communication sent to new subscribers or clients after they sign up for an insurance service or newsletter. This is a crucial moment to make a positive first impression. The welcome email should thank the recipient for joining, introduce them to the services offered, and provide any relevant next steps (e.g., scheduling a consultation or completing a quote request).

Example: A new client signs up for a life insurance policy. The welcome email can provide details about their new policy, explain how to access their account, and invite them to explore additional coverage options.

2. Newsletter Emails

Newsletter emails are sent on a regular basis (weekly, monthly, or quarterly) to provide subscribers with valuable content, updates, and industry news. These emails typically cover a wide range of topics, such as tips for choosing the right insurance, policy changes, or insurance industry trends.

Regular newsletters are a great way to keep your audience engaged and informed, helping you remain top-of-mind with both existing and potential clients. It can also establish your brand as a trusted resource in the insurance industry.

Example: A monthly newsletter highlighting seasonal insurance tips, such as preparing home insurance policies for the winter months or reviewing health insurance options during open enrollment.

3. Promotional Email

Promotional emails are used to highlight special offers, discounts, or new products and services. These emails are designed to capture attention and encourage immediate action, such as signing up for a new policy or renewing an existing one. Promotional emails work well for limited-time offers, seasonal discounts, or exclusive deals for existing customers.

Example: An insurance company may offer a 10% discount on auto insurance for new customers who sign up by the end of the month. The promotional email can include a clear call-to-action (CTA), such as “Get a Quote Now” or “Start Your Application.”

4. Re-engagement Emails

Re-engagement emails are targeted at clients who have become inactive, whether they haven’t opened your emails in a while or have stopped renewing their policies. These emails are aimed at reigniting interest and encouraging recipients to take action, such as completing their renewal or revisiting your website for new offers.

Example: If a client hasn’t opened emails in the past three months, a re-engagement email could ask if they are still interested in receiving updates, offer them an incentive (like a free consultation), or remind them of important policy renewal dates.

5. Claim Process Updates

For insurance companies, keeping clients informed about the status of their claims is essential for maintaining trust. Insurance email marketing can be used to send automated updates on claim processing, approval, or requests for additional information. Timely and clear communication during the claims process helps enhance the customer experience and reduces anxiety.

Example: An email sent after a client submits an auto insurance claim, detailing the next steps in the process, the expected timeline, and what documents are needed for further review.

6. Seasonal Reminder

Seasonal reminder emails are sent at specific times of the year to remind clients about important events or deadlines that may affect their insurance policies. This could include reminders about policy renewals, open enrollment for health insurance, or seasonal home insurance updates (e.g., checking your home for winter damage).

Example: A reminder email before the winter season, advising homeowners to review their home insurance policies to ensure they’re covered for possible winter weather damage.

By utilizing these different types of email campaigns, insurance companies can provide valuable, relevant communication to their clients at every stage of their journey—from the first point of contact to long-term policy renewals. Insurance email marketing is all about delivering the right message at the right time, helping to build trust, foster relationships, and ultimately, drive conversions.

Best Practices for Insurance Email Marketing

To effectively engage clients, boost conversions, and maintain compliance, it’s crucial to follow the best practices in insurance email marketing. By adhering to proven strategies, insurance companies can ensure their email campaigns are well-targeted, relevant, and impactful. Here are some key best practices that will help insurance businesses optimize their email marketing efforts:

1. Build and Maintain a Clean Email List

A successful email campaign starts with a high-quality email list. Insurance email marketing relies on sending targeted messages to the right recipients. It’s important to regularly clean your email list by removing inactive subscribers, correcting any invalid email addresses, and ensuring that you only send emails to those who have opted in.

Maintaining an updated and clean list helps improve deliverability and ensures that your emails reach the right people. Consider using double opt-in techniques to confirm subscribers’ intent and to reduce the chances of sending emails to uninterested recipients.

2. Segment Your Email List for Personalization

One of the biggest advantages of insurance email marketing is the ability to personalize emails based on customer data. Segmentation allows insurance companies to tailor content to specific groups, such as by policy type, customer interests, or geographic location. This makes your emails more relevant to the recipients and increases engagement.

For instance, a customer with a home insurance policy will receive different email content than someone who only has auto insurance. By sending personalized offers, reminders, or content, you’ll create more meaningful interactions with your clients.

3. Craft Compelling Subject Lines

The subject line is the first thing a recipient sees and plays a major role in whether your email gets opened. Craft subject lines that are clear, concise, and enticing. Use action-oriented language and create a sense of urgency or value, but avoid making them too sales-driven or spammy.

For example, a subject like “Get Your Free Auto Insurance Quote Today!” or “Last Chance for 10% Off Your Home Insurance” grabs attention while communicating the value of opening the email.

4. Use a Clear and Strong Call to Action (CTA)

Each email should have a clear call to action (CTA), guiding the recipient towards the desired next step. Whether it’s scheduling a consultation, getting a quote, or renewing a policy, your CTA should be prominent, easy to find, and action-oriented.

Make sure the CTA stands out in your email, using a contrasting button color and concise language. “Get Your Quote” or “Renew Now” are examples of strong, actionable CTAs that lead to conversions.

5. Optimize Emails for Mobile Devices

With a significant portion of emails being opened on mobile devices, it’s essential to ensure your emails are mobile-friendly. This means using a responsive design that adapts to different screen sizes, keeping text readable without zooming, and ensuring that buttons are large enough to tap easily on mobile devices.

A mobile-optimized email enhances the user experience and prevents potential customers from abandoning the email due to poor formatting or hard-to-click links.

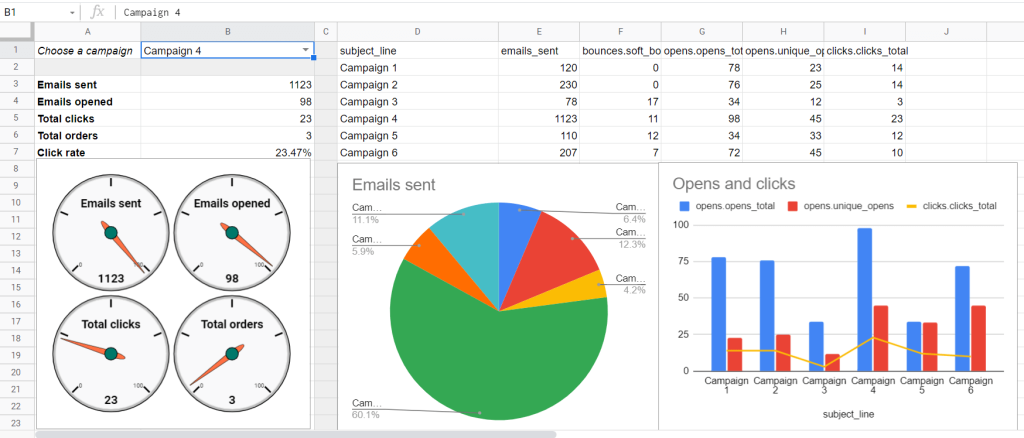

6. Test and Analyze Campaign Performance

To improve your insurance email marketing over time, it’s important to test and analyze the performance of your campaigns. Use A/B testing to experiment with different subject lines, CTAs, designs, and sending times. Analyze metrics such as open rates, click-through rates, and conversion rates to understand what resonates best with your audience.

Based on the data, make adjustments to optimize future campaigns. Over time, you’ll be able to refine your email marketing strategy to achieve even better results.

7. Ensure Compliance with Email Regulations

Compliance with email regulations such as the CAN-SPAM Act, GDPR, and CASL is crucial for protecting your business and maintaining customer trust. Ensure that your emails include an easy-to-find unsubscribe link, provide clear contact information, and allow recipients to manage their preferences.

Respecting privacy laws not only helps you avoid penalties but also demonstrates to your clients that you value their data and privacy.

8. Provide Valuable Content to Your Subscribers

To keep subscribers engaged and encourage them to open your emails, it’s important to provide valuable content. Share tips on choosing the right insurance, explain common policy terms, or offer timely reminders related to their coverage needs. By offering educational and helpful information, you build credibility and trust with your clients.

Well-informed customers are more likely to make informed decisions, which can lead to better engagement and higher conversion rates.

By following these best practices for insurance email marketing, insurance companies can improve their email engagement, drive more conversions, and establish long-term relationships with clients. A focused and strategic approach ensures that email campaigns are not only effective but also provide value to both the business and its clients.

Tools for Insurance Email Marketing

In the fast-paced world of digital marketing, insurance email marketing can be greatly enhanced by using the right tools. These tools streamline the process of creating, sending, and analyzing email campaigns, making it easier for insurance companies to connect with their clients. Whether you’re automating emails, segmenting your audience, or tracking performance, the right tools will save time, improve results, and increase efficiency. Here are some of the top tools for insurance email marketing:

1. Mailchimp

Mailchimp is one of the most popular and user-friendly email marketing platforms. It offers a wide range of features, including customizable email templates, list segmentation, automation workflows, and in-depth analytics. Mailchimp also provides a drag-and-drop email builder, making it easy for insurance companies to create professional-looking emails without the need for coding skills.

For insurance email marketing, Mailchimp’s segmentation tools allow you to target specific groups based on criteria like policy types, renewal dates, and location. This ensures that your emails are personalized and relevant to each recipient.

2. HubSpot

HubSpot is a robust marketing platform that offers a suite of tools designed to help businesses with email marketing, lead generation, and CRM management. For insurance email marketing, HubSpot excels at automating email workflows, personalizing content, and tracking customer interactions.

HubSpot’s CRM allows you to track customer behavior, and integrate this data into your email campaigns. This is especially useful for insurance companies that need to send personalized emails, like renewal reminders or policy updates, based on customer activity.

3. ActiveCampaign

ActiveCampaign is a powerful email marketing tool with advanced automation features. It offers email campaign creation, customer segmentation, and robust reporting, making it a great choice for insurance email marketing. With ActiveCampaign, insurance companies can set up triggered email sequences, such as welcome emails or reminders for policy renewals.

Its automation capabilities also allow you to send timely, relevant messages based on customer actions, like filling out a quote request form or submitting a claim. This ensures that every customer receives the right message at the right time, improving engagement and conversion rates.

4. Constant Contact

Constant Contact is known for its simplicity and ease of use, making it an excellent choice for insurance companies new to email marketing. With features like email templates, list management, and analytics, Constant Contact provides everything you need for insurance email marketing.

It also offers segmentation and automation features, so you can send tailored emails to your clients based on their preferences or behaviors. Whether you’re sending out a monthly newsletter or a policy renewal reminder, Constant Contact makes it easy to stay connected with your clients.

5. SendGrid

SendGrid is a cloud-based email delivery service that is designed to ensure high deliverability rates. It is particularly useful for insurance companies that send transactional emails, such as policy confirmations, claim updates, and payment reminders.

SendGrid offers advanced analytics, which allows you to track open rates, click-through rates, and delivery performance. It also has excellent email deliverability features, ensuring that your emails reach your clients’ inboxes without getting caught in spam filters.

6. Benchmark Email

Benchmark Email is another intuitive tool for insurance email marketing. It offers a variety of pre-designed templates, email automation, and segmentation features to help insurance companies engage with their audience. Benchmark also provides A/B testing capabilities, allowing businesses to experiment with different email designs, subject lines, and CTAs to find what works best.

For insurance businesses looking to optimize their email campaigns, Benchmark’s analytics give detailed insights into how well your emails are performing, helping you refine future campaigns.

7. Drip

Drip is a marketing automation platform that’s well-suited for businesses looking to scale their email marketing efforts. For insurance email marketing, Drip provides powerful segmentation, advanced automation workflows, and detailed tracking. This makes it ideal for sending highly targeted emails, such as promotional offers for new customers or renewal reminders for existing clients.

Drip’s detailed analytics and customer behavior tracking also allow insurance companies to personalize their emails based on past interactions, ensuring every email is relevant and impactful.

Case Studies: Successful Insurance Email Campaigns

Insurance email marketing has proven to be a highly effective tool for increasing engagement, improving customer retention, and driving conversions. By examining successful email campaigns, we can gain valuable insights into what works and how insurance companies can implement these strategies to achieve similar results. Below are some case studies that highlight successful email marketing campaigns in the insurance industry.

1. Case Study 1: Auto Insurance Renewal Campaign

A well-known auto insurance provider wanted to increase its policy renewal rate, as many customers were not renewing their coverage after the first year. The company launched a targeted insurance email marketing campaign to remind clients about their upcoming policy renewal dates. They personalized the emails based on the customer’s policy and sent them in a sequence: a reminder 30 days before the renewal, a follow-up reminder 10 days before, and a final reminder on the day of the renewal.

The campaign also included special offers, such as a loyalty discount for customers who renewed early. To make the emails more engaging, they included a clear call-to-action (CTA) that led customers to their accounts to review and renew their policies.

Results:

- A 25% increase in policy renewal rates.

- A 40% higher click-through rate compared to previous email campaigns.

- A 20% increase in early renewals due to the loyalty discount.

2. Case Study 2: Health Insurance Open Enrollment Campaign

During open enrollment for health insurance, a health insurance company used insurance email marketing to engage potential customers and encourage them to sign up for new plans. They segmented their email list into existing clients and new leads, sending tailored messages to each group.

The emails sent to new leads included an introductory message explaining the benefits of enrolling in health insurance, with detailed information on plan options and how to apply. For existing clients, the emails focused on plan updates, premium adjustments, and reminders about the end of the open enrollment period.

Additionally, the company implemented a series of educational emails, helping recipients understand health insurance terminology, coverage options, and the enrollment process.

Results:

- A 30% increase in new sign-ups during the open enrollment period.

- A 15% increase in email open rates by providing educational content.

- A reduction in the number of last-minute sign-ups thanks to timely reminders.

3. Case Study 3: Life Insurance Lead Nurturing Campaign

A life insurance company wanted to improve its lead nurturing process, as many potential customers were not converting into actual clients. They launched a series of automated emails targeting leads who had shown interest in their products but had not yet purchased a policy.

The campaign included personalized emails with information specific to the lead’s interests, such as term life or whole life insurance, and content that helped educate them about the importance of life insurance. They also included customer testimonials, offering a sense of trust and reliability. To encourage action, each email included a CTA prompting leads to schedule a consultation or receive a free quote.

Results:

- A 50% increase in lead-to-customer conversion rate.

- A 35% increase in email engagement rates (opens and clicks).

- An overall improvement in brand trust and customer satisfaction.

4. Case Study 4: Home Insurance Cross-Selling Campaign

A home insurance company used insurance email marketing to cross-sell other insurance products, such as auto and life insurance, to existing customers. After analyzing their customer data, the company identified customers who had home insurance but no auto or life insurance policies.

They created an email campaign that showcased the benefits of bundling home, auto, and life insurance policies, offering discounts for customers who purchased additional coverage. The emails were personalized based on the customer’s existing policy, with an emphasis on how adding another type of insurance could save them money.

Results:

- A 20% increase in bundled policy sales.

- A 10% increase in cross-sell conversions, particularly for auto insurance.

- Higher customer satisfaction due to the tailored offers and personalized content.

5. Case Study 5: Travel Insurance Campaign for Seasonal Events

A travel insurance company wanted to increase its sales during peak travel seasons, such as summer and the holidays. They used insurance email marketing to target customers who had previously purchased travel insurance or shown interest in it. The emails included a countdown to the start of the travel season, along with limited-time discounts for travel insurance policies.

They also included testimonials from satisfied customers, showing the value of having travel insurance during uncertain times. The emails were designed to be urgent and action-oriented, with a CTA to purchase travel insurance before prices increased.

Results:

- A 40% increase in travel insurance sales during the peak season.

- A 50% higher click-through rate compared to past seasonal campaigns.

- A 30% increase in repeat customers purchasing policies from previous years.

Challenges in Insurance Email Marketing

While insurance email marketing can be highly effective, it is not without its challenges. Insurance companies often face unique obstacles when implementing email marketing strategies, from ensuring compliance with legal regulations to dealing with low engagement rates. Understanding and addressing these challenges is crucial to maximizing the success of your email campaigns. Here are some of the key challenges in insurance email marketing:

1. Deliverability Issues

One of the most significant challenges in insurance email marketing is ensuring that your emails actually reach your recipients’ inboxes. Poor email deliverability can result in your emails being flagged as spam or being filtered into the junk folder. Factors like low-quality email lists, inappropriate subject lines, and even certain words or phrases can contribute to deliverability issues.

To improve deliverability, it’s important to maintain a clean and segmented email list, avoid spammy language, and use verified email addresses. Additionally, regularly checking your email reputation and sender score can help ensure better inbox placement.

2. Compliance with Legal Regulations

In the insurance industry, compliance with various legal regulations is essential. Insurance email marketing is subject to laws like the CAN-SPAM Act, GDPR, and other local privacy laws, which dictate how personal data is collected, stored, and used. Ensuring that your email campaigns comply with these regulations can be a complex task.

For example, all marketing emails must include an opt-out option (unsubscribe link) and the company’s contact information. In regions like Europe, GDPR mandates that consent is obtained before sending marketing communications, and data must be handled securely.

Failure to comply with these laws can lead to penalties, loss of customer trust, and damage to your company’s reputation. To overcome this challenge, make sure to stay updated on legal requirements and use email marketing platforms that help with compliance.

3. Low Engagement and Open Rates

Achieving high open and engagement rates is a common challenge in insurance email marketing. Many recipients may ignore or delete marketing emails, especially if they perceive the content as irrelevant or overly promotional. Insurance companies often struggle to keep their audience engaged, particularly when emails are generic or lack personalization.

To improve engagement, it’s essential to send relevant and personalized content that speaks to the recipient’s specific needs. Using dynamic content, segmentation, and behavioral triggers can help make your emails more relevant. Additionally, optimizing subject lines, providing clear CTAs, and ensuring that your emails are visually appealing can improve open and engagement rates.

4. Overcoming Spam Filters

Spam filters are designed to block unwanted emails, but they can also mistakenly filter legitimate emails into the spam folder. Emails from insurance companies are often flagged as spam due to certain trigger words (e.g., “free,” “guaranteed,” “winner”), excessive use of exclamation points, or even poor email authentication practices.

To avoid being marked as spam, it’s important to follow best practices like using a reputable email service provider, authenticating your email domain, and avoiding spammy language. Consistently sending high-quality, relevant content will also help improve your sender reputation and reduce the likelihood of being flagged as spam.

5. Managing Large and Diverse Audiences

Insurance companies often have a broad and diverse customer base, making it challenging to create email campaigns that resonate with everyone. Different clients may be interested in different types of insurance (e.g., home, auto, life), and sending generic messages to a diverse audience can result in lower engagement rates.

The solution to this challenge lies in segmentation. By categorizing your email list based on customer behavior, demographics, and interests, you can send more targeted, personalized emails that are relevant to each recipient. This approach ensures that the right message reaches the right person at the right time, improving both open rates and conversions.

6. Content Fatigue

With an influx of marketing emails sent to consumers daily, there is a risk of content fatigue—where recipients become overwhelmed and disengaged by the sheer volume of emails they receive. This is particularly relevant for insurance email marketing, where repetitive messages may lead to unsubscribes or customers ignoring emails.

To overcome content fatigue, it’s essential to vary your email content and keep it fresh and engaging. Share valuable information like insurance tips, customer testimonials, seasonal reminders, and personalized offers. Ensure that the frequency of emails is manageable and that each email provides value to the recipient.

7. Data Privacy and Security Concerns

As an insurance company, you handle sensitive client data, which makes data privacy and security a top concern. Customers are increasingly aware of their privacy rights and may be hesitant to engage with email campaigns if they feel their information is not being handled securely.

To address these concerns, ensure that your email marketing system adheres to industry-standard security practices, such as encryption and secure data storage. Also, make it clear to your customers how their data will be used and give them easy access to privacy settings and consent preferences.

Measuring Success: How to Track the Effectiveness of Insurance Email Marketing

To ensure that your insurance email marketing campaigns are delivering the desired results, it’s important to track their effectiveness. Without proper measurement, it’s difficult to know what’s working and what needs improvement. By focusing on key metrics and analyzing performance data, insurance companies can optimize their email marketing strategies and drive better results. Here’s how to track and measure the success of your insurance email campaigns:

1. Open Rate

The open rate is one of the most fundamental metrics in insurance email marketing. It measures the percentage of recipients who open your email compared to the total number of recipients. A higher open rate typically indicates that your subject lines and preheader text are compelling, and that your emails are reaching your audience effectively.

Why it matters: A low open rate might suggest that your emails are being ignored or sent to spam, while a high open rate shows that your audience finds your emails relevant and worth opening.

How to improve it: Focus on creating engaging subject lines that pique the interest of your audience. Test different variations and analyze what works best for your target segments.

2. Click-Through Rate (CTR)

The click-through rate measures the percentage of recipients who clicked on a link or CTA within your email. It’s an important indicator of how engaging your content is and how well your CTAs resonate with your audience. A high CTR means your emails are driving recipients to take action.

Why it matters: The CTR is a direct measure of how well your email content and CTAs are performing. For insurance email marketing, this could include actions such as getting a quote, scheduling a consultation, or purchasing insurance.

How to improve it: Make sure your emails are well-designed, with clear and attractive CTAs. Test different button placements, text, and color schemes to identify the most effective combinations.

3. Conversion Rate

The conversion rate tracks the percentage of recipients who complete a desired action, such as signing up for a new policy, renewing an existing policy, or requesting more information. For insurance email marketing, the ultimate goal is often to drive conversions that lead to increased business.

Why it matters: High conversion rates indicate that your email campaign is effectively driving actions that matter to your business, such as leads, purchases, or consultations.

How to improve it: Ensure your email content is personalized and relevant, and your CTAs are compelling. Use retargeting emails to follow up with leads who haven’t converted yet, and offer incentives such as discounts or special offers.

4. Bounce Rate

The bounce rate refers to the percentage of emails that couldn’t be delivered to recipients’ inboxes. There are two types of bounces: hard bounces (permanent delivery failures) and soft bounces (temporary issues, like a full inbox). A high bounce rate can indicate problems with your email list or delivery practices.

Why it matters: High bounce rates can damage your sender reputation, affecting future email deliverability. Regularly cleaning and updating your email list will help keep this metric low.

How to improve it: Regularly remove invalid or inactive email addresses from your list and ensure that your emails follow best practices for deliverability (such as proper email authentication).

5. Unsubscribe Rate

The unsubscribe rate tracks the percentage of recipients who opt out of receiving future emails. A high unsubscribe rate may indicate that your email content is not relevant or is being sent too frequently. It’s important to monitor this metric closely to ensure you aren’t over-saturating your audience.

Why it matters: If your unsubscribe rate is consistently high, it may signal that you need to adjust your content strategy or frequency. For insurance email marketing, this could mean offering more targeted and personalized content.

How to improve it: Segment your email list more effectively, and send tailored content based on customer behavior. Be mindful of email frequency and ensure that you’re delivering value to your recipients with each email.

6. Return on Investment (ROI)

ROI measures the financial return from your insurance email marketing campaigns compared to the amount spent. This includes both the direct revenue from sales and the long-term benefits, such as customer retention. ROI is essential for understanding the overall success of your campaigns.

Why it matters: A high ROI indicates that your email marketing efforts are cost-effective and contributing positively to your bottom line. For insurance companies, measuring ROI can help justify the continued investment in email marketing.

How to improve it: Optimize email campaigns by focusing on the most profitable segments, testing different offers, and ensuring that your emails are converting at a high rate. Track both direct and indirect revenue from email marketing.

7. Engagement Over Time

Tracking engagement over time helps you understand how your audience is interacting with your emails. This includes monitoring trends in open rates, click-through rates, and conversion rates across multiple campaigns. It’s important to track engagement over time to identify patterns and optimize your long-term strategy.

Why it matters: Engagement over time provides insights into the overall health of your email marketing program. A consistent decline in engagement may signal the need for a campaign refresh or content overhaul.

How to improve it: Analyze past campaigns to identify what worked well and what didn’t. Use these insights to refine your email strategy, whether it’s adjusting content, frequency, or targeting.

Future of Insurance Email Marketing

The future of insurance email marketing holds tremendous potential as technology continues to evolve and consumer expectations shift. Insurance companies that embrace emerging trends and adapt to new tools will be well-positioned to build stronger relationships with their clients, drive higher engagement, and achieve better conversion rates. Here are some of the key trends and innovations that will shape the future of insurance email marketing.

1. Personalization Through Advanced Data Analytics

Personalization is already a key element of successful insurance email marketing, but as data analytics tools become more advanced, the ability to create hyper-personalized content will become even more powerful. By utilizing predictive analytics and AI-powered tools, insurance companies will be able to send even more relevant and tailored messages to their customers.

For example, insurance providers can use customer data to predict when a client may need additional coverage or when they are likely to cancel their policy. This level of personalization can drive higher engagement and conversions by delivering the right message at the right time.

2. Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are poised to transform insurance email marketing. These technologies can automate processes, predict customer behavior, and optimize email campaigns in real-time. For instance, AI can analyze past email campaigns to determine which subject lines, CTAs, and email content are most likely to resonate with different segments of your audience.

Machine learning algorithms can also help improve segmentation and targeting, ensuring that your emails are reaching the right people with the right content. Over time, AI can refine your email marketing strategy to continually improve engagement and conversion rates.

3. Interactive Emails

Interactive emails are set to become more prevalent in insurance email marketing. These emails allow recipients to engage directly within the email itself, rather than simply clicking through to a landing page. Interactive elements like surveys, polls, embedded videos, and clickable images can make emails more engaging and drive higher levels of interaction.

For example, an insurance company might use an interactive email that allows a customer to estimate their coverage needs by selecting different options within the email. These interactive features enhance the user experience and provide valuable insights into customer preferences.

4. AI-Powered Chatbots Integration

Integrating AI-powered chatbots with insurance email marketing is an emerging trend that will provide real-time customer support and personalized experiences. These chatbots can be triggered by specific actions within an email, allowing clients to ask questions, get instant responses, or even receive policy quotes directly through their email.

By offering a seamless chat experience, insurance companies can increase engagement, resolve customer inquiries more quickly, and encourage leads to take action without having to leave their inboxes.

5. Voice Search and Smart Devices

With the rise of smart devices and voice search, the future of insurance email marketing will include optimizing content for voice-based interactions. As more people use voice assistants like Siri, Alexa, and Google Assistant to manage their emails and interact with businesses, it’s important for insurance companies to adapt their email content for voice search queries.

This could involve crafting subject lines and content that are optimized for voice search or creating voice-friendly calls-to-action (CTAs) that clients can activate using their voice assistants. Additionally, integrating voice-responsive features within emails will improve the overall customer experience.

6. Increased Use of Video Content

Video content has already become a powerful tool in digital marketing, and insurance email marketing is no exception. In the future, we can expect to see more insurance companies using video emails to convey complex information, such as explaining policy details, offering tips, or sharing customer success stories.

Video emails are more engaging than traditional text-based emails, and they can help simplify difficult concepts, making insurance policies easier for customers to understand. Additionally, video content tends to have higher engagement rates, leading to better overall campaign performance.

7. Enhanced Customer Journey Mapping

As insurance email marketing evolves, insurance companies will be able to create more advanced customer journey maps to better understand and cater to their clients’ needs. These maps track the different stages of a customer’s relationship with your company, from initial interest to policy renewal and beyond.

By understanding the customer journey, insurance companies can send the right email at the right time, whether it’s a welcome email for new customers, a reminder email for policy renewals, or a personalized recommendation for additional coverage.

Conclusion

In conclusion, insurance email marketing remains one of the most powerful and cost-effective tools for building customer relationships, boosting engagement, and driving conversions. As we’ve seen throughout this blog post, there are numerous strategies, best practices, and tools available that can help insurance companies create impactful email campaigns. From personalization and segmentation to leveraging AI and interactive content, the possibilities for enhancing email marketing efforts are endless.

However, it’s essential to keep in mind that success in insurance email marketing requires constant testing, adaptation, and attention to customer needs. By monitoring key metrics like open rates, click-through rates, and conversions, and by staying up to date with emerging trends and technologies, insurance companies can continuously refine their strategies to ensure they’re delivering the right messages at the right time.

As the digital landscape evolves, those who embrace the future of insurance email marketing—through innovations like AI, voice search optimization, and video content—will be well-positioned to stay ahead of the competition and continue engaging clients in meaningful ways. The key to success is combining technology with a customer-centric approach to create campaigns that not only resonate but also drive long-term business growth.

Now is the time to implement these strategies and set your insurance email marketing campaigns up for success in the years to come.